Fair share contributions and broadband cost recovery – When Google and Netflix talk about things being bad in “Korea”, they probably mean North Korea, not South Korea.

Strand Consult aims to be both tough and knowledgeable when it comes to broadband policy. We reject the premise of “fair share” contributions to connectivity as no one can agree on what’s fair. Instead we prefer the neutral term cost recovery which reflects objective accounting and attribution of costs. Moreover, Strand Consult conducts fact checking and freedom of information requests to create transparency in telecom policy discussion.

For example, companies like Netflix and Google attempt to discredit cost recovery efforts in South Korea, claiming they are harmful to consumers and innovation. While there may be controversy about one policy approach or another, this does not prove that one policy is good and another bad. In practice, policy research is difficult and requires data analysis. Even then, different assumptions can lead to different conclusions.

In this research note, Strand Consult investigates claims about cost recovery from Google and Netflix It suggests data sets which could be examined to test these claims. Strand Consult then presents official traffic data from the South Korea Ministry for ICT for further insight. Strand Consult find that claims from Netflix and Google are so false that they must be talking about North Korea, not South Korea.

South Korea and Strand Consult’s expertise

South Korea is recognized as a global leader in information communications technology (ICT) by the United Nations International Telecommunications Union and the Organization for Economic Cooperation and Development. It ranks at the top of many leading broadband measures published by the OECD, including fiber to the home adoption (87% in 2022) and 5G adoption (45% in 2022). Whatever you think of South Korea, it at least performs well to maximize outcomes for consumers, which should be the top goal for policymakers.

Strand Consult has published reports on South Korea for more than 20 years. Our reports in 2002 and 2003 described how the South Korea market consolidated from 5 to 3 operators and the evolution from CDMA to WCDMA. We have studied South Korea as it relates to the handset market, the network equipment market, and the content market. We have studied South Korean broadband policy, including its soft approach to net neutrality and why it performs better to stimulate innovation than the hard rules deployed in Europe. Recently, we published a comprehensive report on litigation brought by Netflix against SK Broadband, based upon primary research of court documents and other primary source materials South Korean. Over the years we have engaged with South Korean scholars at conferences and have read hundreds of papers about the country’s unique policy approach. Suffice it to say, Strand Consult knows something about South Korea.

Fact Check on Google’s Claims

At the October 2022 FT-ETNO panel The Future of the EU Internet ecosystem – How should all digital actors contribute to a gigabit future? (scroll to 14 min) Google’s EMEA President Matt Brittin asserted that since 2016 in South Korea, “Consumers and businesses pay more either with price or pay in —worse — in services.” Google’s YouTube Korea blog from September 2022 noted the value of YouTube Korea to the Korean economy in 2021 was more than 2 trillion won and likely supported some 86,000 full-time creators in some way, according to a report Google commissioned from Oxford Economics.

Google expressed concern that additional policy to enable cost recovery could ruin or damage the creative industries. It suggests that a cost recovery regime will reduce content creator’s payout and in content development.

Google asserts some points which are not necessarily precise, but a fact check can shed light on whether what Google says is true.

- It’s not clear to which “prices” Brittin refers, but if it is broadband, the trend for broadband in South Korea is lower prices. The European Commission’s own “Mobile and Fixed Broadband Prices in Europe in 2021” reports ,“South Korea shows lower prices for Standalone and Double Play offers in the top speed baskets 100-200 Mbps and >200 Mbps.” This is significant because most Koreans have upgraded to highest speed tiers. It is also informative for EU policymakers to see that their own data suggests that South Korea has lower prices on higher tiers of broadband. Google’s claim about increased prices is false. As a related point, Netflix decreased its subscription prices by introducing an ad-supported Basic subscription tier in South Korea in October 2022. Google’s claim about network usage fees increasing broadband prices in South Korea is false.

- Google’s further claims about reductions to content provider payouts and content development since 2016 are checked. In fact Google contradicts itself saying that Korean content “grows at an annual average of 4.9% and exports at 18.7% over the past five years,” citing the Korea Creative Content Agency. Google’s claim about declining content is also false.

- YouTube offers content creators a shared revenue model of 68% of advertising revenue to Google and 32% to content creators. The payout to any one content creator will vary significantly. Google’s proffered impact to the creative economy of 2 trillion won to 86,000 people amounts to USD $17.44 per creator. This is not to dismiss the value of any artist or the payout, but simply to observe that few can live on YouTube alone. It is significant nonetheless that Google has the freedom to enjoy a shared revenue model with content providers; indeed broadband providers should have the same freedom.

- While YouTube engages with Korea’s creative economy, it can hardly take sole credit for it. The policy to support it has largely been driven by Korea’s taxpayers already. South Korea’s creative industries are significant and reflect decades long effort by the government to create policy, including education policy and strategic subsidies, to incentivize content creation. South Korea is the world’s seventh-largest creative culture player, with USD $114 billion in sales, USD$ 10.3 billion in exports and 680,000 jobs, reported OECD in 2021.

- It is interesting that Google would criticize South Korean policy because its profits have increased in recent years. For example both Google and Netflix reported a breathtaking 90% increase in operating profits in 2021.

- If any harm has come to consumers it is from Google itself. The South Korea Personal Informational Protection Commission (PIPC) fined Google $50 million in September 2022 (the largest ever for such a fine), saying that Google did not clearly inform users or obtain their consent as they collected information about their online activities when they used other websites and apps outside their own platforms. This follows Google being fined $180 million for abusing its dominance in the mobile operating systems and app markets in addition to separate subsequent violations of the country’s app payment rules.

Should Google Search be trusted to provide an objective set of results to investigate this broadband usage fees?

Various queries on keywords related to the cost recovery topic curiously provide a set of results which appear to parrot Google’s position, notably reports attempting to discredit broadband usage fees in South Korea. These reports have been published by trade associations like the US Chamber, Information Technology Industry Council, and Computer and Communications Industry Association, the consultancies Oxera, Chambers and Partners, and Analysys Mason, and non-profit organizations like the Electronic Frontier Foundation, the Carnegie Endowment, and the Internet Society. The reports tend to reference each other without identifying a separate, independent data source which evidences harm. More largely these entities disclose financial support from Google and other large software companies.

One study displays at least one major error, Competitive conditions on transit and peering markets – Implications for European digital sovereignty published for Germany’s Federal Network Agency of Germany Bundesnetzagentur by WIK Consult, a company which bills itself as an authority for regulators. Its attempt to discredit South Korea’s policy begins on p. 36 with a critique of its 2016 IP interconnection regulation, asserting, “In contrast to other parts of Asia, South Korea does not show a trend of falling transit prices. According to Telegeography, in 2021 transit prices in Seoul were 8.3 times higher than in Paris and 4.8 times higher than in New York.“ Strand Consult contacted Telegeography as to whether this conclusion can be drawn from the presentation in the referenced footnote in the report. Telegeography responded in an email, “It does not specifically contain information related to transit prices in Seoul.”

WIK notes further, “Market observers report a decline in diversity of online content and expect rising prices for end users for content, as well as lower network infrastructure investments.” This is referenced with a series of letters and blogs from advocacy organizations and conjecture from policy analysts but no actual evidence. It appears that the Google Search’s results for queries on the topic should be reviewed with a grain of salt. Strand Consult offers additional fact check of these reports.

Fact Check on Netflix’s Claims

Netflix CEO Greg Peter’s addressed the 2023 Mobile World Congress stating, “Some of our ISP partners have proposed taxing entertainment companies to subsidize their network infrastructure… [which] would have an adverse effect, reducing investment in content – hurting the creative community, hurting the attractiveness of higher-priced broadband packages, and ultimately hurting consumers.” He expressed concern that companies beyond Netflix and Google would be charged, as broadcasters shift from linear to streaming. Let’s see how this stacks up to the facts in South Korea.

- It’s interesting that Netflix’s CEO says that cost recovery would hurt its investment in content. If anything, Netflix has supercharged its content investment in South Korea, which is its single-fastest growing geography and source of 4 million new customers. Statista charts Netflix’s increasing investment in South Korea, despite the asserted “bad policy” beginning in 2016, with a whopping $500 million announced in 202 Netflix plans 34 new and returning titles in 2023 for South Korea, double its 2015 lineup. Indeed, Netflix leverages its Korean content for the rest of the world, with 60 percent of viewed worldwide watching some Korean title. The South Korean “Squid Game” was it best performing title in 2021. Contrary to Netflix’s claims, it has increased investment in South Korea, not reduced.

- There are some 23 million broadband subscribers in South Korea, of which 5 million are Netflix subscribers. Under Netflix’s proposal, the broadband provider absorbs storage, processing, and delivery costs which it passes on to all subscribers, whether or not they subscribe to Netflix. There is a simple solution to this problem: broadband providers should add a Netflix Delivery Fee to the bill of the subscribers which receive Netflix. Naturally Netflix would challenge such transparency, but it would empower end users to decide whether Netflix is worthwhile when its true cost is considered. Netflix would blast such an effort as its goal is to drive down the price of broadband so that it can capture a greater share of the consumer’s outlay for broadband and streaming services. Strand Consult’s report “Netflix v. SK Broadband. The David and Goliath Battle for Broadband Fair Cost Recovery in South Korea” details the litigation brought on by Netflix, now in its third year and which Netflix has lost to date given its argument that it “has no obligation to negotiate or pay for the use of others’ networks.” Under Netflix’s proposal, all consumers pay more for broadband rather than just the subscribers which want Netflix.

- Cost recovery is very important to Netflix. It launched a plan address the illegal sharing of account logins. Just as Netflix must cover its costs, broadband providers must as well.

- Netflix also claims that it doesn’t send data to subscribers, but that users merely ask for it. This is not true. Users can’t control how Netflix data behaves on its network as Netflix’s adaptive bitrate technology expands to fill the available bandwidth. While Netflix’s premium subscription tier uses greater bandwidth to increase resolution, the broadband provider does not necessarily make more money even though more of its network resources are used. Strand Consult has documented that Netflix traffic reduces available bandwidth for other users and services. The South Korean usage fee to Netflix is justified to ensure that the requisite bandwidth is provisioned to ensure quality delivery for end users subscribing to Netflix as well as to protect the bandwidth needed for non-Netflix users. Naturally Strand Consult would prefer that content and broadband providers engage in a good faith negotiation to recover costs for content delivery. However Netflix claims that it has no obligation to negotiate or pay for the use of broadband providers’ network. In such a situation, government intervention is justified to protect consumers and property rights.

Given the importance of Korea to its business, it would seem that Netflix would want to ensure that network investments continue in the country and step up to ensure that happens. At the end of the day, broadband providers just want the same freedom pursue two-sided markets model, just like Netflix and Google.

Data from South Korea

Reviewing traffic data from South Korea can also help enlighten the question as to the impact of policy.

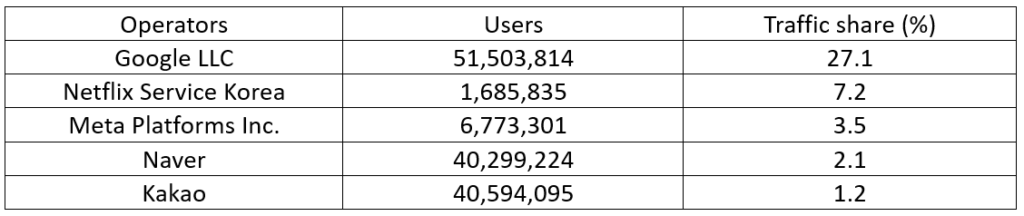

The Service Stabilization Act enshrined in Article 22-7 of the Telecommunications Business Act and administered by the Ministry of Science and ICT requires that the largest content providers engage with broadband providers for cost recovery. Compensation is determined by the parties and is private. The government does not set price levels or mandate fees. The law is only applicable to the 5 largest content providers: Google, Netflix, Meta, Naver, and Kakao, a group which together comprised more than 41 percent of all South Korean traffic in February 2022, at the launch of the regime. For eligibility, these providers must have at least 1 million users per day and comprise at least 1% of South Korea’s traffic. This is important as it is not intended to include the long tail of content providers.

Subsequent legislation has been proposed to ensure that the parties conduct a good faith negotiation and sets penalties for lack of fair dealing.

Data from the official “Traffic status by content type (quarterly)” report follows at the end of this note. For video traffic in South Korea, it shows an overall increase from December 2015 to December 2022 of 2112 TB to 11814 TB, while the percentage of video overall has remained largely unchanged from 57.1% to 56%. In broad terms, this suggests that Google and Netflix have been able to serve increasing amounts of video, regardless of the policy regime and their costs.

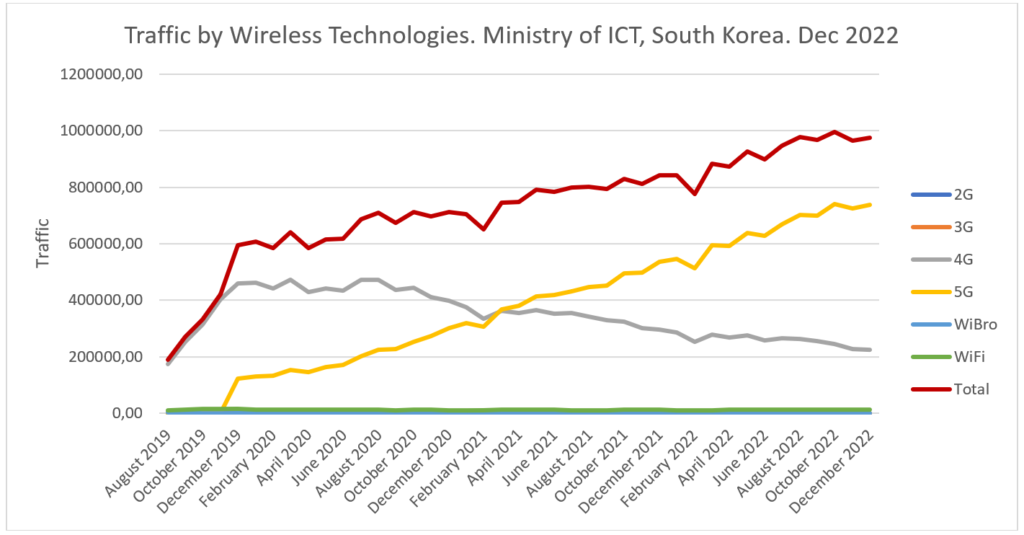

A report on Wireless Data Traffic through December 2022 was obtained from the Ministry of ICT website, the official data used to evaluate the policy in South Korea. Strand Consult prepared in the following chart. It illustrates traffic trends on wireless networks (2G-5G, WiFi, etc.). As to be expected, 4G traffic declined as people have switched to 5G. The unmistakable trend is an increase in traffic for all technologies. Note that Wi-Fi traffic is extremely low compared to all mobile cellular networks.

The chart demonstrates a consistent increase in data over time. This suggests that content providers increasingly provide data. Notably if usage fees were so onerous, content providers would stop serving content and hence a decline in traffic could be observed. Alternatively there could be investment in compression technology to reduce bandwidth consumption, which would also a positive outcome for the responsible use of networks.

Google and Netflix fail the fact check

South Korea’s ICT success is the result of many factors over years, and given the country’s track record of continuous improvement, its policymakers deserve credit for getting it right. As such, we should be suspicious when Google and Netflix make sweeping claims that its policies harm consumers and innovation. Indeed these companies have demonstrated increasing revenue, profits, traffic, and users in South Korea. It is logical that when network bandwidth increases, however it is paid for, Google and Netflix would tend to benefit. Greater bandwidth would seem to enable improved rendering and resolution of video, whether for ads or other content. That this could translate to greater revenue for Google and Netflix is plausible.

In fact, Strand Consult find that claims from Netflix and Google are so false that they must be talking about North Korea, not South Korea.

To learn more about South Korea and the Network Free Ride Prevention Act, including an English translation of the bill, order Strand Consult’s report Netflix v. SK Broadband. The David and Goliath Battle for Broadband Fair Cost Recovery in South Korea